Welcome to our detailed guide on today’s gold price for 1kg. We cover the latest market rates and trends here. If you’re keen on following the current gold price, you’re in the perfect spot. At BullionVault, we provide a gold price chart that’s updated in real time and shows information in various currencies.

Our gold price chart is packed with useful features. It updates every 10 seconds and stores data for up to 20 years. This is great for both experienced investors and those new to gold. Our chart helps you see long-term trends and make smart choices.

At BullionVault, you have the option to buy gold in several currencies. Thanks to our live order board, placing your orders is straightforward. We’re committed to offering a smooth and easy-to-use service. Our goal is to make your investment process hassle-free.

Live Gold Spot Price Chart

Follow the live gold spot price with BullionVault’s gold price chart. It updates in real-time, showing gold’s price in various currencies like US Dollars, British Pounds, and more. You get the latest information from different places around the world.

The gold price chart refreshes every 10 seconds. This means you always know the newest market rates. It’s perfect for all investors, new or experienced, offering key insights.

This chart doesn’t just show real-time prices. It also gives you 20 years of historical data. This helps you see long-term trends and understand how gold prices change over time.

BullionVault’s live order board lets you place gold orders easily. You can trade in big markets like Zurich, London, and New York. This makes buying gold simpler and helps you tweak your investment plan.

Keep up with the gold market using BullionVault’s chart. You get current updates and historical insights and can order confidently. All the details you need are right there for you.

Key Features:

- Real-time updates on live gold spot price

- Multiple currency options

- Up to 20 years of historical data

- Global market access through live order board

Make smart investment choices with BullionVault’s gold price chart. Now, you can watch the live gold spot price, study past trends, and make orders right away. Start today.

Gold Price Today

The gold price today focuses on the current spot price in the wholesale market. London’s biggest bullion banks decide on a price. This helps clear orders. They do this at 3 pm in London on UK working weekdays.

The Daily Price of gold is given in troy ounces. This is in US Dollars, Euros, and British Pounds. It helps investors and buyers make smart decisions. By placing orders before the price is set, you can lock in the price. This can boost your investment.

The gold price is not shared on weekends or UK public holidays. That’s because the market is closed then.

Keeping an eye on the gold price helps investors understand the market. It’s vital for anyone buying gold or considering it as an investment. Staying current with the gold price matters.

Gold Price Per Gram

Thinking about investing in gold? It’s quite popular to buy gold by the gram. It suits retail investors well. GoldCore has a selection of gold bars and coins just for this.

The price for gold per gram comes from the spot price for an ounce. An ounce equals 31.1 grams. To find the gram price, divide the ounce spot price by 31.1. This helps investors keep up with the gram price, which changes with the market.

There are good reasons to invest in gold by the gram. It’s a way to start small, which makes entering the precious metals market easier. Also, it lets investors buy the exact amount they want, fitting their goals and budget.

Buying gold per gram could help diversify your investments, protect against inflation, or own real assets. GoldCore makes it easy and convenient to invest in gold with its range of gram-sized bars and coins.

Gold Price Per Ounce

The gold price per ounce is set by the market’s spot price. It’s measured in troy ounces, a bit more than regular ounces. A troy ounce equals 31.1 grams. Prices change with market conditions and currency values. Knowing the latest trends is vital for investors.

GoldCore gives up-to-date gold prices in several currencies. Investors can check the latest prices in US Dollars, Euros, British Pounds, or Australian Dollars on our website. It’s important to keep up with the gold price for smart investing.

Advantages Of Monitoring The Gold Price Per Ounce

- Diversification: Watching the gold price helps investors add variety to their portfolios. Gold is a safe choice during economic ups and downs, adding stability.

- Timing: Knowing the current price helps decide the best times to buy or sell gold. It’s about understanding the market to make the best moves.

- Comparison: Checking prices in different currencies shows where rates are best. This helps investors spend their money wisely.

Keep track of the gold price with GoldCore to make wise investment choices. Our reliable data aids in navigating the gold market effectively.

Gold Price Chart FAQ

The gold price chart from BullionVault is key for watching and understanding gold prices. It answers many common questions:

What Are The Features Of The Gold Price Chart?

- Real-time updates: The chart updates gold prices in real time. This means you’re always in the know.

- Customizable time scale: You can set the time scale to see price changes. Options include 10 minutes, 1 hour, and so on.

- Mobile tracking: With the BullionVault App, tracking gold prices on your phone is easy. This lets you check prices everywhere.

What Data Does The Gold Price Chart Provide?

The chart shows detailed gold price data. You can see today’s price and past prices too. This helps you see long-term trends and make smart investments.

How Can I Interpret Trends On The Gold Price Chart?

The chart helps you understand gold price trends. By looking at past prices, you can spot patterns and changes. This knowledge is key for buying or selling gold.

The chart includes 20 years of historical data. It’s great for investors or anyone interested in gold prices. BullionVault makes it easy to follow the market.

Gold Price Trends And Historical Performance

In recent years, gold has shown amazing growth, hitting record highs. It’s a solid hedge against the downturns in other investments like stocks and real estate. This makes it a strong part of a diversified investment strategy.

Gold prices are moved by many factors, including supply and demand, central bank policies, and inflation. By adding gold to their portfolios, investors can reduce risk. It helps spread out their investment risks.

Gold’s historical prices show its worth and growth potential. This makes it a good choice for those wanting stability and growth in their investments.

Gold stands strong in uncertain economic times or inflation, keeping its value well. Its consistent performance makes it a trusted asset for protecting against inflation and saving wealth.

To understand gold’s value, take note of the following points:

1. Historical Gold Price Data

Gold’s price history offers insights into its performance over the years. Investors use this data to spot trends and make smart decisions. This helps them predict and take advantage of future market changes.

2. Investment Performance

Gold has been a solid investment, attracting investors globally. Its track record shows its reliability and potential for growth. It’s known for keeping its value and growing wealth over time.

3. Hedge Against Inflation

Inflation makes traditional currencies lose value, but gold stands strong. It has been a dependable shield against inflation, keeping its buying power and protecting wealth.

Gold’s trends and past performance show its potential and stability as an investment. It’s great for those looking to diversify and protect their investment portfolio.

Investing In Gold

Gold is often seen as a safe investment, especially in uncertain times. It acts as a safe place for investors during economic downturns. By investing in gold, you lower the risk linked to other investments.

There are many ways to invest in gold. You can buy gold bars or coins. This physical gold gives a sense of security to those who prefer having it on hand. You can also choose gold securities, like certificates, funds, or ETFs. These represent gold ownership and make investing easy.

Gold is good protection against inflation. When inflation lowers currency values, gold prices usually go up. This helps maintain its buying power. Historically, gold moves opposite to the stock market, making it good for diversifying portfolios.

Central banks globally keep gold as a reserve. This shows gold’s lasting value and stability. Gold is also easy to buy and sell worldwide.

GoldCore offers many gold investment options. They sell physical gold bars and coins. They also offer gold securities, like Xetra-Gold.

The Benefits Of Investing In Gold:

- Safe Haven Investment: Gold is a secure choice in uncertain economic times.

- Diversification: It helps spread out risk in investment portfolios.

- Hedge against Inflation: Gold can maintain purchasing power as prices rise.

- Gold-Backed Securities: These offer an easy way to invest in gold without needing physical gold.

Choosing to invest in gold can protect wealth against market changes. Gold provides stability and growth potential. Look into the options and talk to experts like GoldCore for advice on the gold market.

Global Gold Market And Production

Gold is mined everywhere, earning its title as the “king of metals.” South Africa is the biggest producer. It holds 16% of the global market share.

The United States, Germany, and France also produce a lot of gold. They have large gold reserves. This makes them important players in the gold market.

Gold reserves are key for economic stability. They are a safe asset during tough economic times. The United States, Germany, and France have big gold reserves. This helps their economies stay strong.

Gold stocks have grown over the years. Gold can be kept forever without losing value. This shows why gold remains important in finance.

But, the gold industry faces some issues. These include mining costs and the need for skilled workers. To succeed, the industry must be creative and adapt.

Gold prices change due to supply, demand, and central bank actions. Investors must understand these factors. They affect gold prices and market stability.

The gold market is crucial for the global economy. Gold’s value and uses make it a key asset. It plays a major role in financial systems around the world.

Gold As An Industrial Raw Material And Jewelry

Gold is a key industrial material because of its unique features. It has excellent conductivity and is very malleable. The electrical sector uses gold a lot because it carries electrical signals well.

This makes it vital for electronics like phones, computers, and communication gear. Gold also plays a big role in dental technology. It’s used in fillings, crowns, and more because it’s safe and lasts a long time.

Gold doesn’t corrode, and it doesn’t react with mouth fluids. This makes it ideal for dental work that needs to last. The jewellery business uses about 75% of the gold. Its durability, beauty, and scarcity make it sought-after for jewellery.

Gold’s lasting appeal and value over time make it a prized investment. It’s also seen as a symbol of wealth and beauty.

Factors Affecting Gold Prices

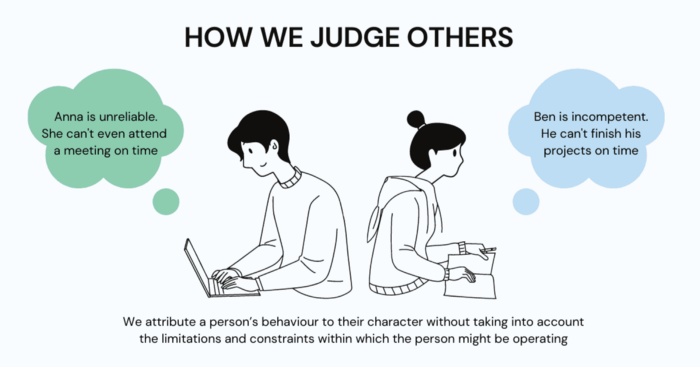

Various factors lead to changes in gold prices. It’s important for investors to know these elements. This helps them make smart choices.

Supply And Demand Dynamics

Supply and demand are key in setting gold prices. The amount of gold available and demand from both investors and industries affects its value.

Monetary Policy

Central banks’ monetary policies also shape gold prices—changes in interest rates and measures like quantitative easing influence gold’s attractiveness.

Inflation

Inflation influences gold prices, too. People see gold as a safe bet against inflation. When inflation rises, so does the demand for gold, driving prices up.

Market Performance

Other financial markets’ performance impacts gold demand. During economic troubles or market dips, investors might turn to gold. This can increase its demand and price.

Articles and analysis often look into gold prices’ current trends and reasons. They are key for investors wanting to grasp gold market dynamics.

Conclusion

Investing in gold can be a smart move for diversifying your portfolio. It helps protect against inflation and market changes. Gold prices have hit record highs in different currencies lately. By keeping an eye on gold prices and studying the past, you can make smart choices.

Gold is known as a safe investment, appealing to both individual investors and central banks. It shields against inflation and economic ups and downs. Websites like BullionVault and GoldCore make investing in gold easier. They provide up-to-date price data and other helpful services.

Considering the market’s ups and downs, gold can help stabilize your investments over time. Its proven track record and current trends offer a strong case for it. For those looking to safeguard and increase their wealth amid financial uncertainty, gold is a solid choice.

FAQ

What Is The Gold Price Today?

The gold price today shows the current spot price. This price comes from London’s largest bullion banks at 3 pm London time during the work week. It’s shown in US Dollars, Euros, and British Pounds for troy ounces. No price is given on weekends or some UK holidays. If you order before the daily price comes out, you keep the price shown.

How Can I Track The Live Gold Spot Price?

Use BullionVault’s gold price chart to track it live. This chart updates in real time and shows gold’s current market price. It also gives you up to 20 years of past data. You can change the time scale to see price changes over different periods.

How Is The Gold Price Per Gram Calculated?

It’s based on the current spot price per troy ounce. Since one troy ounce equals 31.1 grams, dividing the spot price by 31.1 gives the price per gram. This price changes with the market and currency.

What Is The Gold Price Per Ounce?

The gold price per ounce follows the market’s spot price. It’s measured in troy ounces, which are heavier than regular ounces. A troy ounce equals 31.1 grams. The price for an ounce can change depending on the market and currency.

What Features Does The Gold Price Chart Offer?

BullionVault’s gold price chart lets you pick the time scale for different periods like 10 minutes to a day. It updates in real time and in different currencies. Plus, you can check the price on your mobile device through the BullionVault app.

Why Should I Invest In Gold?

Investing in gold has many benefits. It’s been strong recently and can protect against losses in other investments. Gold adds variety to your investments and guards against inflation and market uncertainty. It’s also valued historically and has investment potential.

How Can I Invest In Gold?

You can buy gold physically as bars or coins or use securities. Options include gold certificates, gold funds, or ETFs. GoldCore lets you invest in physical gold and gold-backed securities, including Xetra-Gold.

Where Is Gold Mined And Produced?

Gold is mined everywhere, with South Africa leading globally. The USA, Germany, and France have large gold reserves. Gold’s global supply increases over time because it’s not used up and lasts forever.

What Are The Uses Of Gold Outside Of Investment?

Beyond investment, gold is key in the electrical and dental industries due to its conductivity. It’s been used for centuries in these areas. The jewellery industry also uses a lot of gold for its lasting beauty.

What Factors Affect Gold Prices?

Gold prices change with supply and demand, central bank actions, inflation, and other market performances. These changes can increase or decrease gold’s value.

How Can I Make Informed Investment Decisions?

To decide wisely, track gold prices and study trends. BullionVault and GoldCore give you up-to-date gold market data and history. This information helps you stay on top of the gold market.